Advertisement

|

Beasley Q1 Net Rev Increases 2.6% to $55.2M

| RADIO ONLINE | Monday, May 7, 2018 |

|

|

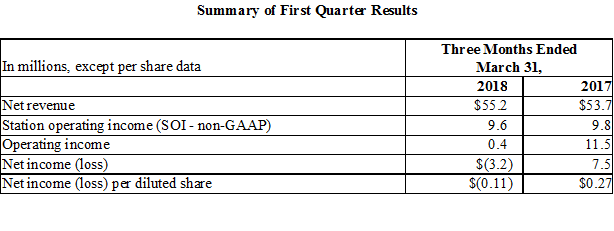

Beasley Broadcast Group, Inc. has announced operating results for the three months ended March 31, 2018, realizing a 2.6% increase of net revenues to $55.2 million.

On May 1, 2017, the Company completed the sale of six stations in Greenville-New Bern-Jacksonville. On December 19, 2017, Beasley completed an asset exchange transaction whereby the Company exchanged its Boston adult contemporary station WMJX-FM and $12.0 million for Boston's sports station WBZ-FM. The results presented herein reflect the operations and results from WBZ-FM in the three months ended March 31, 2018 and the Greenville-New Bern-Jacksonville stations and WMJX-FM in the three months ended March 31, 2017.

|

Station Operating Income (SOI, a non-GAAP financial measure) declined 1.5% year-over-year in the first quarter of 2018. The decrease reflects higher station operating expenses related to the operations of WBZ-FM Boston, partially offset by the station operating expense decline due to the disposition of the Greenville-New Bern-Jacksonville stations and WMJX-FM Boston. Station operating expenses for the three months ended March 31, 2018 were comparable to station operating expenses for the same period in 2017 at our remaining market clusters. Collectively, the increase in station operating expenses offset the increase in net revenue.

Operating income was $0.4 million in the first quarter of 2018 compared to $11.5 million in the first quarter of 2017. The year-over-year decrease in operating income is primarily attributable to the $11.9 million year-over-year change in the fair value of contingent consideration due to changes in our stock price affecting the value of the Class A common stock to be returned to the Company in settlement of the purchase price adjustment in connection with the acquisition of Greater Media and related sale of Greater Media's tower assets. In addition, the Company incurred a total of approximately $1.0 million in the quarter ended March 31, 2017 for transaction expenses, other expenses and loss on disposition of assets.

The 2018 first quarter net loss reflects the lower operating income during the period and a $0.8 million year-over-year increase in income taxes, as the company recorded a $0.4 million tax benefit in the year ago first quarter, which partially offset a $1.2 million year-over-year reduction in interest expense in the 2018 first quarter. As a result, net loss for the 2018 first quarter was $3.2 million, or $0.11 per diluted share.

Commenting on the financial results, Caroline Beasley, Chief Executive Officer, said, "In the first quarter of 2018, we continued to execute well on our integration strategy focused on strong local programming to support our goals of ratings and market leadership at recently acquired stations, while implementing our operating and expense management disciplines.

"On a reported basis, 2018 first quarter net revenue rose 2.6% compared to the prior year, primarily reflecting our first full quarter of results from our Boston station swap, partially offset by the revenue included in the comparable 2017 period from divested stations. The $1.6 million increase in station operating expenses was largely attributable to the Boston market's sports leader, WBZ-FM, and additional one-time costs related to New England Patriots' Super Bowl programming. However, the ongoing success of our expense management initiatives resulted in a year-over-year reduction in operating expenses at our Tampa, Charlotte, Detroit, Fort Myers and Augusta clusters. As a result, while Beasley's SOI declined 1.5% year-over-year, after excluding the SOI contribution from the Greenville-New Bern-Jacksonville station divestitures from the comparable 2017 period, first quarter SOI would have been flat.

"With our strong operating cash flows we have invested in our broadcast and technology platforms while pursuing select accretive acquisitions and station swaps. At the same time, Beasley remained committed to enhancing shareholder value through capital returns and capital structure improvements. In this regard, during the first quarter, we increased our quarterly cash dividend by 11.1% and declared our nineteenth consecutive quarterly cash dividend. In addition, interest expense decreased approximately $1.2 million year-over-year, reflecting the recent refinancing of our senior debt, which reduced our interest rate by 200 basis points. We also used cash from operations to make voluntary debt repayments of approximately $3.0 million and ended March 31, 2018 with total outstanding debt of $222 million.

"Looking ahead, Beasley's ongoing diversification and commitment to local content, innovation and growth has positioned us to capitalize on the many opportunities to serve listeners and businesses in our local markets throughout 2018. We look forward to realizing the strategic benefits of our recent transactions and intend to continue our strategic priorities of reducing debt and leverage, taking advantage of political revenue opportunities, improving top- and bottom-line performance and returning capital to shareholders through our quarterly cash dividend. As the number one reach medium, with 93% of the U.S. population tuning in weekly, we remain confident in the radio industry and believe that Beasley's ongoing initiatives to drive sales, productivity and efficiency across our platform, combined with prudent management of our capital structure, is a proven formula for sustained long term financial growth and the creation of shareholder value."

The Company will host a conference call and webcast today, May 7, 2018, at 10:30 a.m. ET to discuss its financial results and operations. To access the conference call, interested parties may dial 719/325-4745, conference ID 7239783(domestic and international callers). Participants can also listen to a live webcast of the call at the Company's website at www.bbgi.com. Please allow 15 minutes to register and download and install any necessary software. Following its completion, a replay of the webcast can be accessed for five days on the Company's website, www.bbgi.com.

Advertisement

|

Latest Radio Stories

FCC Hits Pirate Stations with Fines Exceeding $850,000

|

Nielsen Releases 2024 Annual Marketing Report

|

NAB Radio Board Election Results Announced

|

Advertisement

|

Doug Stephan's Good Day Restructures for Weekends, Flex

|

iHeartMedia Wins Webby Podcast Company of the Year

|

''Chachi Loves Everybody'' Releases Two New Episodes

|