Advertisement

|

Beasley Reports Record Q3 Net Revenue of $66.1 Million

| RADIO ONLINE | Thursday, November 7, 2019 | 6:49am CT |

|

|

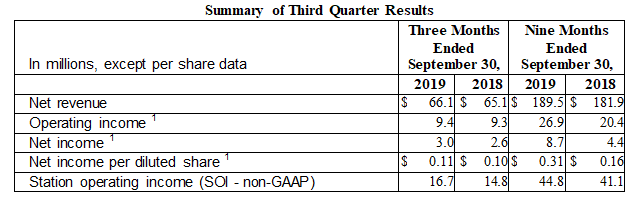

Beasley Broadcast Group, Inc. has announced operating results for the three-month and nine-month periods ended September 30. The results presented herein reflect actual results including the operations of WXTU-FM in the three- and nine-month periods ended September 30, 2019 and the operations of WDMK-FM for the month of September 2019.

¹Operating income, net income and net income per diluted share were impacted by a $4.4 million charge due to the change in fair value of contingent consideration in the nine months ended September 30, 2018 and a $3.5 million gain on dispositions in the nine months ended September 30.

The $1.0 million, or 1.5%, year-over-year increase in net revenue during the three months ended September 30, 2019, reflects increased revenue in the Company's Philadelphia, Detroit, Boston, Charlotte, Fayetteville, and Wilmington market clusters. Net revenue for the three months ended September 30, 2019 was comparable to net revenue for the same period in 2018 at the Company's other market clusters.

Beasley reported operating income of $9.4 million in the third quarter of 2019 compared to operating income of $9.3 million in the third quarter of 2018 as higher net revenue and lower station operating expenses in the 2019 period more than offset a rise in corporate general and administrative expenses and depreciation and amortization expenses during the period. Third quarter 2019 interest expense increased by approximately $0.3 million to $4.4 million reflecting additional borrowings related to recent acquisitions. Beasley reported net income of $3.0 million, or $0.11 per diluted share in the three months ended September 30, 2019, compared to net income of $2.6 million or $0.10 per diluted share in the three months ended September 30, 2018. The increase was primarily due to expenses related to a securities offering in 2018.

Station Operating Income (SOI, a non-GAAP financial measure) increased 12.7% year-over-year in the third quarter of 2019. The year-over-year increase is primarily attributable to higher revenue in the 2019 third quarter and lower station operating expenses related to $1.7 million of non-recurring bad debt expense that was recorded in the comparable 2018 period, partially offset by higher expenses at recently acquired stations.

Commenting on the financial results, Caroline Beasley, Chief Executive Officer, said, "Throughout the third quarter, we continued to advance our revenue diversification initiatives and actively manage our local radio broadcasting and digital platforms, while implementing our operating disciplines at recently acquired stations to drive SOI growth and margin expansion. Record third quarter net revenue of $66.1 million was driven by the strength of our station clusters in four of our top five largest revenue markets, as well as contributions from recent acquisitions and more than offset the approximate $0.9 million of combined political, spectrum and United States Traffic Network traffic revenue recorded in the 2018 third quarter, which did not recur in the 2019 third quarter. Reflecting the strong operating leverage in Beasley's business model and the non-recurrence of the bad debt charge recorded in last year's third quarter our 1.5% revenue growth drove a 12.7% year-over-year increase in SOI and overall margin improvement.

"We remain focused on strong local programming to support our goals of ratings and market leadership across all of our audio platforms, while making strategic investments to expand our digital capabilities to better serve our listeners and advertisers. On August 31, we completed the accretive and deleveraging acquisition of WDMK-FM, which is complementary to our three existing radio stations and digital operations in Detroit and moves us closer to our goal of achieving 30% revenue share in the market. The integration is proceeding according to plan, and we look forward to realizing the benefits of the transaction as we move into 2020. The success we are achieving through our disciplined approach to acquisitions is further reflected by the 24% year-over-year increase in pro-forma third quarter revenues at WXTU-FM, which returned to our Philadelphia cluster just one year ago. Overall, we are extremely pleased with the value we are extracting from recent transactions, which have enhanced our revenue share and competitive position in several key markets.

"Third quarter results also began to reflect financial contributions related to our new and expanding digital development and diversification initiatives. Beasley generated a year-over-year increase in digital revenue of approximately 37%, with digital now accounting for 7.4% of total revenue, compared to 5.4% of total revenue in the prior year period. Going forward, we remain committed to increasing digital share of total revenue as we continue to aggressively roll out our digital transformation strategy across the organization. Our strategies are targeted at expanding our production of quality content, growing audiences and strengthening our digital sales support teams to deliver custom, multi-platform turnkey marketing solutions to advertisers and brands.

"In addition to our growth and diversification initiatives, we remain committed to enhancing shareholder value through capital returns and leverage reduction. In the third quarter, we used cash from operations to pay our twenty-fourth consecutive quarterly cash dividend and made voluntary debt repayments of $2.5 million, with total outstanding long-term debt of $253 million as of September 30.

"Looking ahead, Beasley has built a solid foundation to continue pursuing a range of near- and long-term growth opportunities that create new value for our listeners, advertisers, online users, eSports fans and shareholders. Beasley's ongoing initiatives to drive sales, productivity, diversification and efficiency across our platform, combined with prudent management of our capital structure, is a proven formula for sustained long term financial growth and enhanced returns for our shareholders."

Conference Call and Webcast Information

The Company will host a conference call and webcast today, November 7, 2019, at 10:00 a.m. ET to discuss its financial results and operations. To access the conference call, interested parties may dial 334/323-0522, conference ID 2175708 (domestic and international callers). Participants can also listen to a live webcast of the call at the Company's website at www.bbgi.com. Please allow 15 minutes to register and download and install any necessary software. Following its completion, a replay of the webcast can be accessed for five days on the Company's website, www.bbgi.com.

Advertisement

|

Latest Radio Stories

Connoisseur Ups DiPrima to Station Manager in Long Island

|

Rick Savage Returns to 91X as MD/Morning Host

|

Sean Brace Joins Middays with Marks on 97.5 The Fanatic

|

Advertisement

|

Corny Koehl Named Senior Fellow at D2C Justice Institute

|

Podtrac Releases February Podcast Industry Rankings

|

Shea Expands Role as Tech Systems Director at Connoisseur

|